SOUTH FLORIDA

Home Sales Down, Average Price Up

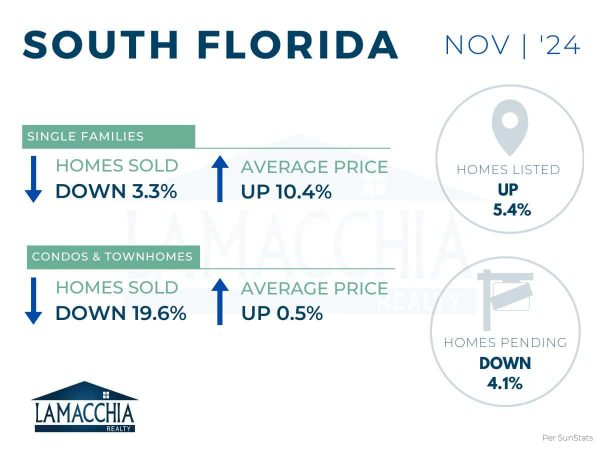

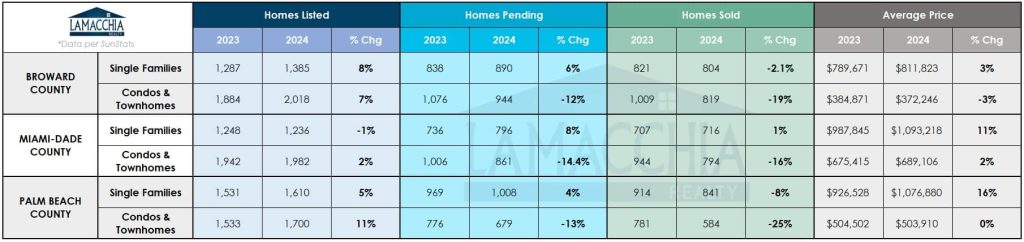

Home sales are down 11.9% year over year, with November 2024 at 4,558 compared to 5,176 last November. Sales are down across all categories.

- Single families: 2,442 (2023) | 2,361 (2024)

- Condos & Townhomes: 2,734 (2023) | 2,197 (2024)

Average sale price increased 9.6% year-over-year, now at $762,150 compared to $698,157 in November 2023. Prices increased across all categories.

- Single families: $898,269 (2023) | $991,574 (2024)

- Condos & Townhomes: $519,419 (2023) | $521,826 (2024)

Homes Listed For Sale in South Florida:

The number of homes listed is up by 5.4% when compared to November 2023.

- 2024: 9,931

- 2023: 9,425

- 2022: 8,371

Pending Home Sales in South Florida:

The number of homes placed under contract is down by 4.1% when compared to November 2023.

- 2024: 5,178

- 2023: 5,401

- 2022: 5,600

Market data provided by SunStats then compared to the prior year.

What’s Happening in the South Florida Market?

- In November 2024, national home sales climbed 6.1% compared to a year ago, marking the biggest year-over-year gain since June 2021. Despite this trend, South Florida saw a decrease in home sales.

- The decline in overall sales and pending transactions suggests a slowdown in buyer demand. Recent changes in regulations for townhomes and condos have increased costs for owners, which could be contributing to the overall sale price increase. As a result, many of these properties are becoming less affordable for buyers, further influencing market dynamics.

- According to Mortgage Daily News, mortgage rates in November, dropped from about 7% to 6.8% by month’s end. However, rates began climbing again in December, peaking at 7.14% on the 19th.

- Great news for homebuyers! In 2025, the FHFA is increasing the conforming loan limit to $806,500—up $40,000 from 2024. Despite market challenges, constrained inventory and high demand continue to drive prices up. This change helps buyers access higher loan amounts to keep pace with rising home values.

As we navigate the adjusting market and the impact it’s having on buying, selling, renting, and homeownership, being informed is one of the first steps in knowing what to do next. Click on the button to visit the South Florida Real Estate Updates page and never hesitate to contact us with questions.

Instant Home Evaluation

Additional Resources

November 2024 South Florida Housing Report

SOUTH FLORIDA Home Sales Down, Average Price Up Home sales are down 11.9% year over year, with November 2024 at 4,558 compared to 5,176 last

November 2024 South Florida Housing Report

SOUTH FLORIDA Home Sales Down, Average Price Up Home sales are down 11.9% year over year, with November 2024 at 4,558 compared to 5,176 last